Retirement planning: How to secure your golden years

As you age, retirement planning becomes increasingly important. Many Americans worry about how to maintain their standard of living after retirement and ensure they have enough money to enjoy their golden years. So, how can you plan your retirement so that you can enjoy your retirement with peace of mind? Let's explore it step by step.

I. Major Changes in Pensions

1.1 Adjustment of Full Retirement Age

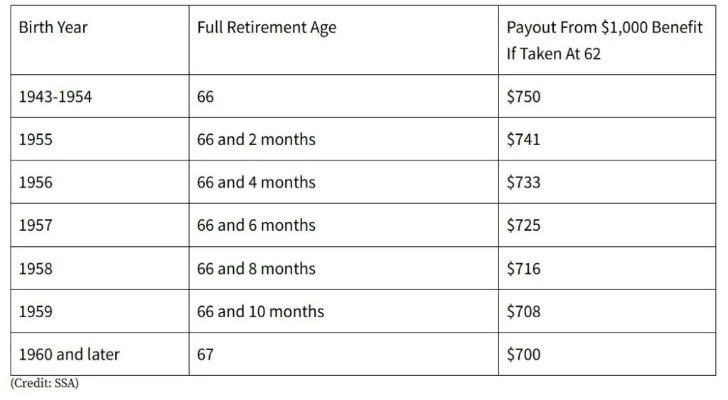

Full Retirement Age: In the past, the age for receiving full pension was 65, but as life expectancy increases, this age is gradually increasing. For example, people born in 1958 need to wait until 66 years and 8 months to receive full pension, while people born in 1959 need to wait until 66 years and 10 months.

Selective Benefits: Although you can start receiving pensions at age 62, the amount will be reduced. On the contrary, waiting until age 70 to receive can get a higher amount.

1.2 Cost of Living Adjustment (COLA)

- 2.5% increase: The cost of living adjustment in 2025 is 2.5%, which means that the average monthly pension will increase by about $49, from $1,927 to $1,976.

- Impact on living: While this increase will help offset some inflation, it is still not enough for many people to cope with the rising cost of living, such as housing, food, and medical expenses.

1.3 Adjustment of the maximum taxable income

- Maximum taxable income: In 2025, the maximum taxable income cap will increase from $168,000 to $176,100. This means that high earners will pay more of their income in Social Security taxes.

II. Impact on living of pension changes

2.1 Economic impact

- Insufficient income increase: Many retirees are concerned that the 2.5% increase is not enough to cope with the rising cost of living. For example, housing and medical costs continue to rise, making life more difficult for retirees.

- Supplemental income: Some retirees have to find part-time jobs to supplement their income. For example, Sherri Myers, an 82-year-old retiree from Florida, plans to find an hourly job at Walmart to make ends meet.

2.2 Impact of medical expenses

- Medicare Part B costs: In 2025, the standard monthly fee for Medicare Part B will increase from $174.70 to $185, and the annual deductible will also increase from $240 to $257.

- The impact of prescription drug costs: Although the government has introduced policies to reduce prescription drug costs, this is still a focus for many retirees.

III. How to deal with changes in retirement benefits

3.1 Plan ahead

- Start saving early: Starting to save for retirement as early as possible can help you cope with possible financial pressures in the future.

- Diversify your investments: Manage risk by diversifying your investments and ensure your retirement account maintains steady growth over the long term.

3.2 Choose a flexible retirement time

- Flexible retirement options: Choose the most suitable retirement time based on your financial situation and health. Waiting until 70 years old to receive a pension can get a higher amount, but it depends on your personal situation.

IV. Real Case

1.Elizabeth Hui is a 73-year-old retiree who relies on her husband's pension for many years after his death. Since she can only get 50% of her husband's pension, she has to pay more than $7,000 in property taxes each year, which accounts for almost all of her pension income. Therefore, she decided to sell her house and move to a low-cost community in Florida to reduce her financial burden.

2.John is a 65-year-old retiree who originally planned to take his pension at age 62, but due to economic circumstances, he decided to take his full pension at age 66 and 8 months. By delaying for a few years, he not only received a higher pension, but also used this time to continue working and saving.

V. Find out if your pension has changed

The pension changes in 2025 will have a profound impact on the lives of many Americans. By understanding these changes and planning ahead, you can better prepare for possible economic challenges in the future and ensure that you have a better quality of life in retirement.