Microfinance in Norway: Helping Individuals and Communities Develop

Microfinance, as a special financial service, plays an important role worldwide. It provides small amounts of money to low-income groups to help them get rid of poverty and achieve economic independence. Norway, as a highly developed Nordic country, also has unique explorations and practices in the field of microfinance. This article will explore Norway's microfinance system in depth, analyze its characteristics, advantages, and impact on local social and economic development.

I. Characteristics of Microfinance in Norway

1. Government-led and Market-oriented

- The Norwegian government encourages financial institutions to actively participate in microfinance business by formulating preferential policies and providing financial subsidies.

- The government has also established a sound regulatory system to ensure the healthy and orderly development of the microfinance market.

- The introduction of market mechanisms has prompted microfinance institutions to continuously innovate products and services and improve service efficiency.

2. Focus on Social Benefits

- Microfinance institutions in Norway not only pursue profits but also pay more attention to social benefits, regarding poverty alleviation as their primary goal.

- The loan recipients are mainly low-income groups, ethnic minorities, women, and other vulnerable groups.

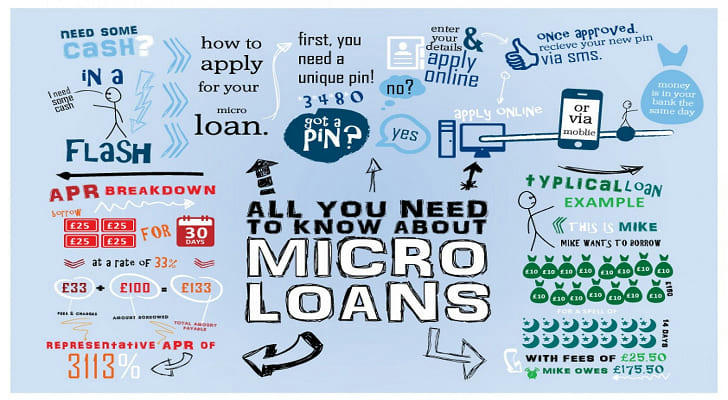

- The loan interest rate is relatively low, and the term is flexible, reducing the repayment burden of the borrower.

3. Diversified Loan Products

- In addition to traditional credit loans, Norway has also developed loan products for specific groups, such as agricultural loans for farmers and education loans for students.

- These diversified products meet the needs of different groups and increase the coverage of microfinance.

4. Perfect Regulatory System

- The Norwegian government has established a strict regulatory system to regulate the qualifications, business scope, interest rates, etc., of microfinance institutions.

- At the same time, the government has also strengthened the protection of borrowers to prevent problems such as excessive borrowing.

II. Advantages of Norwegian Microfinance

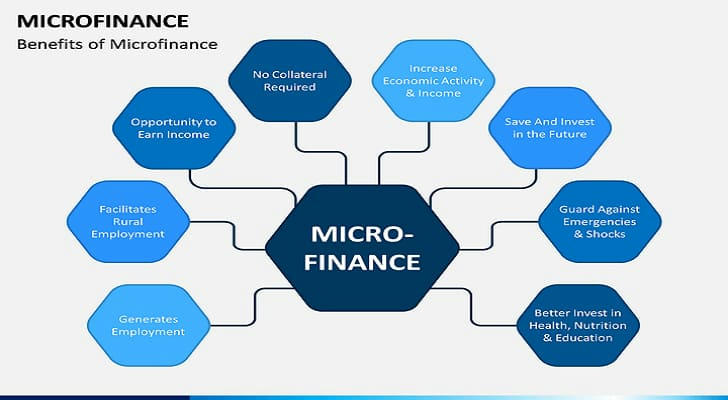

1. Reduce Poverty Rate

- Microfinance provides start-up funds for low-income groups to help them get rid of poverty and achieve economic independence.

- Through continuous loans and financial services, it promotes economic development in rural areas and narrows the income gap between urban and rural areas.

2. Promote Employment

- Microfinance supports the growth of a large number of small and micro enterprises and creates a large number of employment opportunities.

- Especially for women and young people, microfinance provides more entrepreneurial opportunities.

3. Enhance Community Vitality

- Microfinance promotes the development of community economy and enhances community cohesion.

- Borrowers improve the level of community governance by participating in community activities.

4. Improve Financial Inclusion

- Microfinance extends financial services to groups that are difficult for traditional financial institutions to reach, improving financial inclusion.

- Promotes the diversified development of the financial market.

III. Borrowers of Norwegian Microfinance

1. Low-income Groups

- Including the unemployed, low-income families, and the disabled.

2. Minorities

- Minorities such as the Sami and Finns in Norway are also the main beneficiaries of microfinance.

3. Female Entrepreneurs

- The Norwegian government pays special attention to female entrepreneurship and provides more loan support for women.

4. Small and Micro Business Owners

- Microfinance provides start-up capital and working capital for small and micro enterprises.

5. Agricultural Operators

- Agricultural loans in Norway are mainly used to purchase production materials such as agricultural tools, fertilizers, and seeds.

IV. Loan Content of Norwegian Microfinance

Norway's microfinance content is rich and varied, mainly including:

1. Entrepreneurship Loans

- Support individuals or small businesses to start new businesses, purchase equipment, rent venues, etc.

2. Housing Loans

- Help low-income families improve housing conditions, purchase or renovate houses.

3. Agricultural Loans

- Support farmers to purchase agricultural tools, fertilizers, seeds, livestock, etc., and improve agricultural production efficiency.

4. Education Loans

- Help students pay tuition, living expenses, etc.

5. Consumer Loans

- Meet the daily consumption needs of families.

V. Case Analysis of Norwegian Microfinance

Case 1: Microfinance in Norwegian Fishing Communities

- There are many small fishing communities along the coast of Norway. Through microfinance, local fishermen can buy new fishing gear, repair fishing boats, improve fishing efficiency, and increase income. This not only improves the living standards of fishermen but also promotes the development of local fisheries.

Case 2: Support for Norwegian Women's Entrepreneurship

- The Norwegian government encourages women to start businesses through microfinance projects. These loans not only provide financial support to female entrepreneurs but also provide entrepreneurship training and consulting services to help them start their own businesses successfully.

VI. Conclusion

The successful experience of Norwegian microfinance shows that microfinance is not only a financial tool but also an important means of social development. Through microfinance, we can help more people achieve economic independence, improve their quality of life, and promote the harmonious development of society.