How to get a loan with bad credit?

Are you in a pinch for cash due to an emergency, even with a less-than-perfect credit score? Fear not, because a bad credit history doesn't mean you're out of options. Here are some ways to secure a loan when you have bad credit, which I hope will be of assistance.

Ways to Get a Bad Credit Loan

1. The Right Online Lender for You

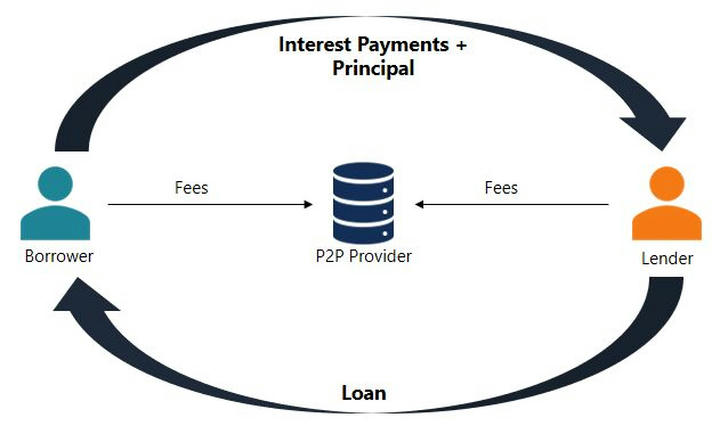

Online lenders have become a vital alternative for those with poor credit scores. They consider your employment history, overall financial situation, and repayment ability. By focusing on these broader criteria, online lenders can offer loans that are more accessible than those from traditional banks.

- Example: Smava is Germany's first peer-to-peer lending platform, connecting private borrowers with individual investors to provide personal loans from €1,000 to €120,000. Its relaxed review conditions and low-interest loans are designed to assist individuals with bad credit.

- Another Platform: Auxmoney also offers bad credit loans and small personal loans. You simply register your personal information on its official website and await review. From March 1, 2008, to February 8, 2015, Auxmoney facilitated over 30,000 loans totaling €160 million, with an average return of 9.65% for investors.

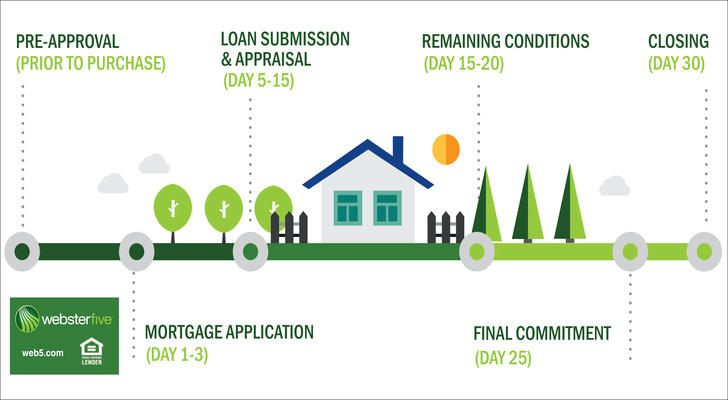

2. Mortgage

If you possess a valuable item, such as a car or luxury goods, you can use it as collateral for a loan. This can provide the lender with more security, potentially leading to better loan terms.

If you have a house and some assets, it's even better, and you can more easily get a home equity line of credit. This allows you to borrow money based on the value of your home, usually at a lower interest rate than an unsecured loan, and the amount will be higher.

3. Credit Unions

These community-focused banks prioritize helping people over maximizing profits. They may be willing to lend to you even if your credit score is not high, and they typically offer competitive interest rates.

4. Co-signer Loans

Having someone with a high credit score willing to co-sign for you can ease the loan approval process. However, remember that if you fail to repay, their credit will be affected.

5. Payday Alternative Loans

Some credit unions offer payday loans, which are small loans designed as a more affordable alternative to traditional payday loans. They usually have lower interest rates and fees, making them suitable for short-term financial assistance for those with bad credit.

Real Case: Oportun Financial Corporation

In the United States, Oportun Financial Corporation specializes in providing financial services to low- and middle-income consumers, including those with no credit score or limited credit history. Through its proprietary lending platform and data analysis technology, the company offers loan services at lower prices, including personal and auto loans.

Advantages of Oportun:

- No credit history is required for a loan.

- Small loans are available, starting as low as $300.

- Flexible repayment terms.

- Low interest rates, reducing the repayment burden on borrowers.

- No annual fee is charged, which reduces the financial burden on cardholders.

6. Credit Building Loans

Some lenders offer small loans to help you improve your credit score and may require you to take financial management courses to better manage your money.

7. Alternative Income Verification

Lenders may consider other ways you generate income, such as freelancing or rental income. A stable side job may help you secure a loan.

8. Friends and Family

If you have a close relationship with someone willing to lend you money, ensure you both agree on repayment terms. Maintain a professional approach to preserve your relationship.

Things to Consider

- Interest Rates: Compare rates to ensure you get the best deal.

- Fees: Be aware of any additional fees, such as application or early repayment penalties.

- Repayment Terms: Understand the monthly payment schedule and total cost.

- Credit Impact: Timely payments can help repair your credit score, facilitating future loans.

Conclusion

Securing a loan with bad credit is achievable. The key is to know where to look, use the internet to find lenders and information, compare your options, and manage your money wisely. Understand your credit, explore different borrowing options, and choose the one that best suits your situation. Stay informed and manage your finances proactively to maintain financial health.