Flexible Financial Services in Austria: One More Choice, One More Possibility

In modern society, capital needs are becoming increasingly diversified. Traditional bank loans often have a long approval process and high requirements for borrower qualifications. To meet the financial needs of more people, some non-traditional financial institutions have gradually emerged in Austria to provide more flexible financial services. These services, often referred to as "flexible financial services", are characterized by fast approval and low thresholds, providing a new financing channel for those who are in urgent need of funds but do not meet the conditions for traditional bank loans.

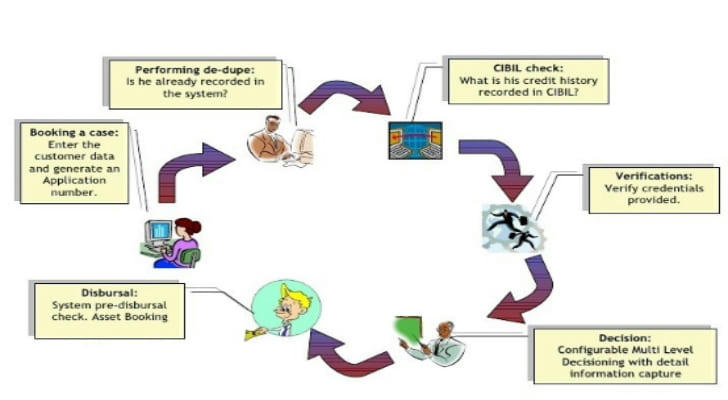

The Cumbersome Process of Traditional Bank Loans

I. What Are Flexible Financial Services?

Flexible financial services refer to financial services with a simpler approval process and more relaxed borrowing conditions compared to traditional bank loans. Such services are usually provided by non-bank financial institutions, such as some small loan companies, P2P lending platforms, etc. Compared with traditional bank loans, flexible financial services pay more attention to the actual needs and repayment ability of borrowers, rather than simple credit scores.

II. Advantages of Flexible Financial Services

Fast Approval: According to data from the Austrian Financial Supervisory Authority, the average approval time for flexible financial services is more than 50% shorter than that of traditional bank loans. For example, Anna, a small and micro business owner, urgently needed funds to purchase new equipment. Through flexible financial services, she got the loan within three days and met the production needs in time.

Low Threshold: A survey of Austrian small and micro business owners showed that more than 60% of small and micro business owners said that flexible financial services helped them obtain loans that traditional banks could not provide. Mark is a freelancer. Because he did not have a stable income certificate, he could not get a loan from the bank, but through a small loan company, he successfully obtained a loan to buy new office equipment.

Product Diversification: Flexible financial services have a rich variety of products. In addition to traditional cash loans, they also include consumer installments, credit lines, etc. For example, college student Xiao Li wants to buy a laptop. Through consumer installments, he can repay the loan in installments, which reduces financial pressure.

Simple Procedures: Applying for flexible financial services usually only requires providing basic information such as ID card and bank card, without cumbersome mortgage guarantee procedures.

III. Where Can I Get Flexible Financial Services?

In Austria, there are mainly the following types of institutions that provide flexible financial services:

Small Loan Companies: According to statistics from the Austrian Financial Supervisory Authority, small loan companies occupy the largest share of the flexible financial services market in Austria.

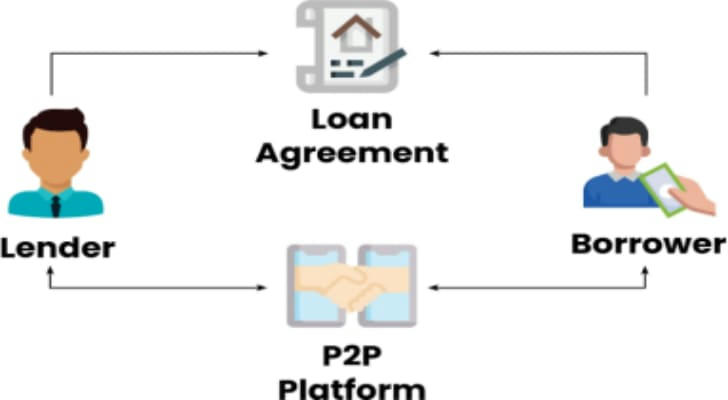

P2P Lending Platform: In recent years, P2P lending platforms have developed rapidly in Austria, building direct financing channels for borrowers and investors.

Consumer Finance Companies: Consumer finance companies cooperate with major retailers and e-commerce platforms to provide consumers with convenient consumer credit services.

IV. Who Are Flexible Financial Services Suitable For?

Flexible financial services are mainly suitable for the following groups of people:

People Who Are in Urgent Need of Capital Turnover: A survey of users of flexible financial services in Austria showed that more than 70% of users said that they used flexible financial services for emergency or short-term capital turnover.

People With Poor Credit Records: According to data from the Austrian Credit Information Agency, more and more individuals with poor credit records have obtained loans through flexible financial services.

Small and Micro Business Owners: Flexible financial services provide important financing support for small and micro enterprises in Austria and promote the innovation and development of small and medium-sized enterprises.

V. Consumer Protection

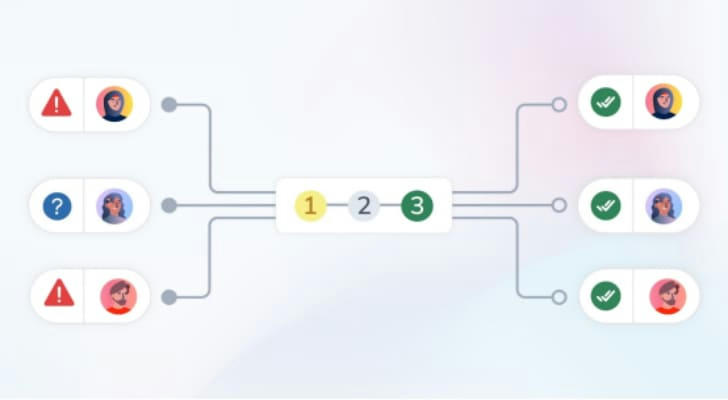

While enjoying the convenience brought by flexible financial services, consumers should also pay attention to protecting their own rights and interests. In recent years, the Austrian government has strengthened supervision of the flexible financial market and issued a series of consumer protection regulations, such as:

Interest Rate Cap: The maximum interest rate for flexible financial services is stipulated to prevent usury.

Information Disclosure: Financial institutions are required to disclose the terms of the loan contract in detail to consumers, and consumers have the right to know all the information of the loan, including interest rates, handling fees, fees incurred by overdue repayments, etc.

Dispute Settlement Mechanism: A complete consumer complaint and dispute settlement mechanism has been established.

Conclusion

The development of flexible financial services in Austria provides people with more financing options. It should be noted that when choosing flexible financial services, consumers should carefully compare the products and interest rates of different institutions and evaluate their own repayment ability to avoid falling into debt. At the same time, consumers should actively understand their rights and seek help in a timely manner when encountering problems.