Christmas season financial savior: A complete guide to Christmas loans in the United States

Christmas, a holiday full of joy and peace, is often accompanied by a significant increase in consumer spending. For American families and individuals with limited budgets, Christmas loans have become an effective way to relieve holiday financial pressure. This article will explore relevant information about Christmas loans in the United States, including the institutions that provide loans, the amount of loans available, and the people who are suitable for applying for such loans, and demonstrate the practical application of Christmas loans through case analysis.

Ⅰ. Overview of Christmas Loans

A Christmas loan is a type of personal loan designed specifically for the festive season to help borrowers cover Christmas-related expenses such as gift shopping, family gatherings, travel, etc.

Ⅱ. Institutions that can lend money

In the United States, multiple financial institutions offer Christmas loans, and here are some of the well-known loan providers:

1. Best Lenders

SoFi

Applicable people: Individuals with stable income and good credit record

Loan amount: $5,000 - $100,000

Features: SoFi offers personal loans to help borrowers with a variety of financial needs, including extra expenses during the Christmas period. SoFi is known for its low interest rates and flexible repayment options.

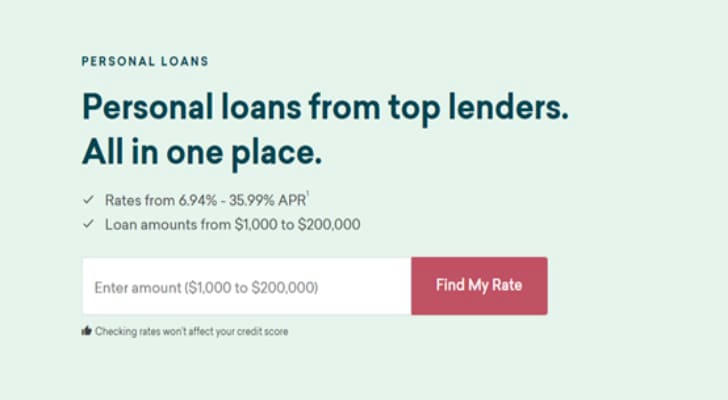

Credible

Applicable people: Individuals who need to obtain funds quickly

Loan amount: $600 - $100,000

Features: Credible is an online lending platform that offers a variety of personal loan options, including Christmas loans. Through Credible, borrowers can compare rates and terms from multiple loan providers to find the loan option that's best for them.

Marcus by Goldman Sachs

Who’s it for: Individuals with good credit scores seeking unsecured personal loans

Loan amount: $3,500 - $40,000

Features: Marcus offers fixed-rate personal loans, suitable for borrowers looking for an unsecured loan to meet holiday expenses.

Discover Personal Loans

Who’s it for: Individuals with good credit scores who need flexible loan options

Loan amount: $2,500 - $35,000

Features: Discover offers personal loans popular for its no hidden fees and daily interest rate pricing.

BHG Financial

Features: BHG Financial stands out for offering the largest loan amounts (up to $200,000), and you have up to 10 years to repay the loan, but you need an annual income of at least $100,000 to qualify.

2. Christmas loans for people with bad credit

OneMain Financial OneMain Financial offers a variety of options for personal loans with bad credit. There is no minimum credit score required (if you apply directly to OneMain), you will receive funds within 1 to 2 business days of acceptance, and you can borrow between $1,500 and $20,000.

Universal Credit There is no minimum income requirement, funds can be funded within one business day, and you can get a loan from $1,000 to $50,000. For the above institutions, you can choose to repay within 2 to 7 years or longer. For specific information, please refer to the official website of credible.

Ⅲ. Who is suitable for Christmas loans?

Family on a Budget: Families who need extra funds to cover holiday expenses.

Holiday Shopper: Individuals looking to purchase holiday gifts and decorations.

Festival Traveler: People who plan to travel during the festival but are on a tight budget.

Small Business Owners: Business owners who need funds to increase inventory or cover increased operating costs during the holiday season.

Ⅳ. Loan application requirements

Credit requirements Different financial institutions have different credit requirements for Christmas loans. Some institutions may have higher credit score requirements, while others may focus more on a borrower's employment and income status.

Loan amount Christmas loan amounts are typically determined based on the borrower's financial situation and needs, ranging from a few hundred dollars to a few thousand dollars. Borrowers should apply for an appropriate loan amount based on their actual needs.

Repayment plan Borrowers need to develop a reasonable repayment plan to ensure on-time repayments to avoid overdue penalties and credit score damage. Many financial institutions offer flexible repayment options so borrowers can choose the repayment method that works best for them.

Ⅴ. Case analysis

Success Story: Festival Financial Solutions

The Johnson family in Los Angeles hosts a large family gathering every Christmas. In 2023, they face budget pressure due to increased unexpected expenses. Through the Credible platform, they applied for a $5,000 Christmas loan, successfully paid for holiday decorations and party expenses, and plan to repay the loan through holiday savings in the coming months. The loan helped them maintain holiday traditions while avoiding financial ruin.

Ⅵ. Conclusion

Christmas loans provide American families and individuals with a financial tool to cover holiday expenses. Although these loans can relieve short-term financial pressure, borrowers should carefully consider their ability to repay and develop a reasonable budget plan. By taking advantage of a Christmas loan wisely, people can keep their holiday traditions alive while avoiding long-term financial hardship. With the festive season quickly approaching, a Christmas loan is certainly an option worth considering for those who need extra funds to celebrate.