Bad Credit Loan: Quickly Solve Financial Difficulties and Regain Financial Confidence

Are you in urgent need of funds but stuck because of a bad credit record? In life, a damaged credit record is often a "stumbling block" to obtaining traditional loans, but a bad credit loan can open a new door for you. It can not only help you get funds quickly, but also help you gradually repair your credit and regain financial initiative.

Ⅰ. Why is it difficult for people with bad credit to obtain traditional loans

In most countries, credit records are managed by specialized credit information agencies that record a person's credit history and financial behavior. If a person's credit record contains overdue payments, debt arrears, or other negative information, it may be marked as "bad credit." Traditional banks usually refer to credit records when evaluating loan applications, and people with bad credit are usually rejected for loans because of their higher risk of default.

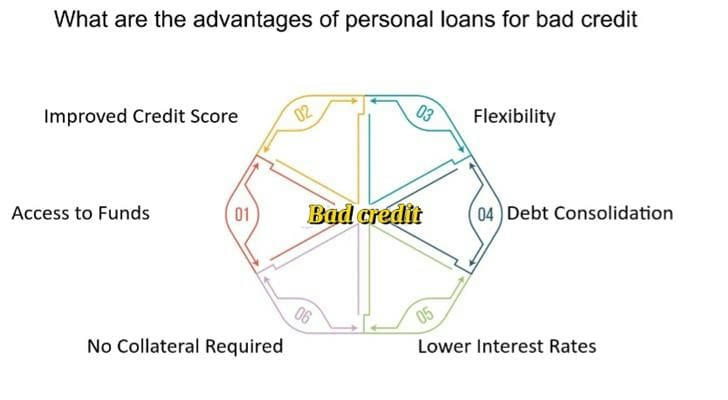

Ⅱ. Advantages of choosing bad credit loan services

1.Emergency funding needs: When faced with sudden financial needs, such as medical expenses, home repairs, or other unforeseen expenses, bad credit loans can quickly provide financial support.

2.Credit repair: By repaying on time, borrowers can gradually improve their credit records and lay the foundation for better loan conditions in the future.

3.Flexible loan options: Bad credit loans usually provide flexible repayment terms and fast approval processes, which can meet the needs of different borrowers.

4.Personalized services: Some lenders not only consider credit records when evaluating loan applications, but also comprehensively consider the borrower's personal situation and repayment ability to provide more humane services.

Ⅲ. Which institutions provide bad credit loans

•Local banks: Some local banks pay more attention to long-term relationships with local customers and may flexibly handle loan applications based on personal circumstances.

•Online loan platforms: These platforms usually provide fast application processes and flexible loan options, which are suitable for borrowers who are in urgent need of funds.

•Private lenders: Private lenders usually pay more attention to the borrower's repayment ability and willingness rather than pure credit history, and may provide more personalized services.

•Credit repair agencies: These agencies not only provide loans, but also provide credit repair plans to help borrowers gradually improve their credit status.

Ⅳ. Real case: Thomas's entrepreneurial story

Thomas is a young entrepreneur who runs a small cafe. Due to the impact of the epidemic, the cafe business was in trouble, which prevented him from repaying his credit card debt on time and damaged his credit record. As the epidemic eased, Thomas saw an opportunity to restart his business, but he urgently needed funds to purchase equipment and raw materials.

Due to his poor credit record, his loan application was rejected by several traditional banks. On the recommendation of a friend, Thomas contacted an online loan platform that focuses on bad credit loans. Based on his personal situation and repayment ability, the platform provided him with a loan of 10,000 euros with a repayment period of 36 months. Thomas said: "It is difficult to get a loan with bad credit, but the online loan platform fully understands my personal situation and the approval speed is very fast. By repaying on time, I believe my credit record will gradually improve."

Ⅴ. How to apply for and start enjoying the service of bad credit loan

1.Research and comparison: Before applying, it is recommended to compare the bad credit loan products provided by different institutions, understand their respective interest rates, repayment periods, application conditions, etc., and choose the loan plan that best suits you.

2.Prepare necessary documents: Usually you need to prepare documents such as ID card, income certificate, credit report, etc., so that they can be submitted quickly during the application process.

3.Submit application: After selecting a suitable lending institution, submit a loan application through its official website or offline channels, and fill in the application form and upload the required documents as required.

4. for approval: After submitting the application, the lending institution will evaluate and approve the application. The approval time varies from institution to institution, and usually the approval speed of online loan platforms is faster.

5.Sign a contract: After approval, the lending institution will sign a loan contract with the borrower to clarify the terms such as loan amount, interest rate, and repayment method.

6.Repay on time: After obtaining a loan, the borrower should strictly repay on time in accordance with the contract to maintain a good credit record.

⭐ Conclusion

Although traditional banks have a low tolerance for people with bad credit, some local banks, online loan platforms, private lenders, and credit repair agencies are still willing to provide loans to people with bad credit. By choosing the right lending institutions and platforms, borrowers can obtain funds in a short time to solve urgent needs.